The Vibe Is Wrong

Brett Christophers' The Price Is Wrong, reviewed

The Price Is Wrong presents a compelling frame: the supposed saviors of the planet, solar and wind, aren’t displacing fossil fuel use in electricity generation fast enough to keep global warming to 1.5 degrees. It then details an impressive litany of reasons why their economics doesn’t work, emphasizing that the attention paid to the cost declines that these technologies have experienced isn’t as significant as their limited potential for profits. The reasons why renewables have poor profitability vary from dramatic --cannibalization -- to the basic -- price instability amidst high interest rates for a capital intensive investment, all of which leave projects in a difficult situation when facing the need to raise cash to build the thing. Bankers may love clean electricity, but they need to believe that they will be paid back and as such have to believe in a project’s revenue streams if they are going to choose to fund a solar/wind farm rather than something with more solid economics.

This tour of electricity markets and their distortions is often fascinating, but looking at the energy transition with this frame feels like looking through a small window to gaze out at a vast ocean, where the tide is rapidly changing. In particular, it obscures how fast and strong the current renewable wave is despite the pricing problems the book illuminates. Similarly, by focusing on the economic difficulties these technologies face, the political challenges can feel inconsequential when in fact reality is closer to the reverse.

To be clear, everyone should read this book. When I teach the politics of climate change, a core idea is mitigation means decarbonization. The primary path to decarbonization is to (1) build out clean electricity generation and (2) simultaneously electrify everything. Electricity matters, and we need to start sweating the details of how it operates. The Price Is Wrong goes through many parts of the electrical system and how money flows through and around it.

A key contention of the book is that much of the enthusiasm for renewables has come from their dramatic cost declines. These are measured in “levelized cost of electricity” (LCOE). I’ve posted these graphs before, and for good reason. They show that we can generate clean electricity cheaply, and thus decarbonize without simply giving up our energy-intensive lifestyles. They are at the core of the green growth vs. degrowth debate.

Christophers acknowledges these cost declines but argues that under capitalism, we need to focus not on their unit cost but on their total cost and their profitability. Their total cost isn’t just the panels/turbines themselves, but the land that they need to be deployed and the grid infrastructure to connect them from that land (often quite remote for cost reasons) to areas with high demand (load, in electricity world).

For a normal product, lower costs imply higher profits. Certainly lower costs aren’t bad for renewables’ profitability, but they aren’t a panacea. The way that most markets for electricity buy and sell power centers on the price offered for the final megawatt (dispatch). In most electrical systems in Europe and the United States, those tend to be gas plants. They tend to be the price setters, but those prices can fluctuate hugely, making the scale of the profits of the renewable developers uncertain. Financiers for gas plants then can have some confidence that even if both the costs and the revenues of a plant will be uncertain since both natural gas and electricity prices fluctuate, they will be price-setters that can ensure that some kind of a margin pads their transactions, making profits reliable. Christophers emphasizes that renewable projects get stymied here because of the uncertainty of their profits.1 This pushes them to try to make deals to stabilize their revenues and hence profits. These can be varied in their form. Most notable are long-term deals like power purchase agreements with those wanting to guarantee procurement of clean power (read: tech companies), contracts-for-difference where state policies (usually in Europe) guarantee a given payout regardless of market pricing, or even options contracts that represent a financial hedge against particularly low revenues. Perhaps the most insane story in the book is how wind developers with these kinds of hedging contracts actually lost huge amounts of money when prices spiked in Texas during the February 2021 Winter Storm, not because the prices were low but because they weren’t producing sufficiently and so had to purchase at the insane spot prices to fulfill their obligations. The actual profits in that episode accrued to Bank of America, who held the hedge.

It’s worth dwelling on this outlier for a moment. The grids of Texas and Oklahoma and other nearby states suffered when a deep freeze settled on them, particularly because they were under-weatherized. Natural gas flows stopped, coal beds froze, wind turbines stopped generating. It’s important to wrap our heads around the weirdness that is the grid. We need electricity to make electricity. Think of all of the pumps, valves, fans, etc that a power plant or gas mining facility will have. If those are shut off, then the plant can’t run. This is one of the reasons why a full black out is so difficult to deal with and “black starts” are to be avoided at all costs. In both Texas and Oklahoma, customers paid dearly, both in the moment of the disaster and financially for decades to come. Hundreds died in Texas from exposure, carbon monoxide poisoning, and other causes. Oklahoma’s public utilities experienced “abnormal energy expenses” in the billions, and though these debts exceeded the book value of these firms themselves, defaulting was apparently not in the cards. Instead, the oil and gas-controlled politicians in Oklahoma agreed to impose bonds on ratepayers which they will be paying back for years. “The “typical” ONG [Oklahoma Natural Gas] residential customer will pay an extra $5.72 to $7.82 per month for 25 years to retire that debt, records indicate.” Texas had similar experiences, with retail competition leading some citizens to be directly exposed to spot electricity rates and thus headlines like: His Lights Stayed on During Texas’ Storm. Now He Owes $16,752. Texas is also piling on fees to electricity and gas bills to pay for storm-related expenses that exceed six billion dollars.

The book also emphasizes that renewables remain dependent on subsidies for their economic viability. Most people who make this kind of a claim are fossil fuel supporters, which to be clear Christophers isn’t. He’s trying to combat the withdrawal of subsidies that is happening in part because of the prevalence of the idea that renewables can stand on their own without government supports due to their super low LCOE. Yet this line of argumentation can get a bit baroque, parsing distinctions between stabilization and subsidization — is it fair to say that an operator who never receives a dollar/euro from a government agency isn’t helped by the promise that if conditions were different she would receive such a subsidy? The unemployment safety net surely helps people sleep at night even if they don’t ever receive payments from it, but to say that it subsidizes them is a stretch.

These points are well taken. There’s lots more in this book to chew on. And many have: Matt Huber’s review in Jacobin, a Guardian review, Ted Nordhaus’s expected dose of renewable hate as review, great interviews with Odd Lots, Volts, etc, but let me turn to my concerns.

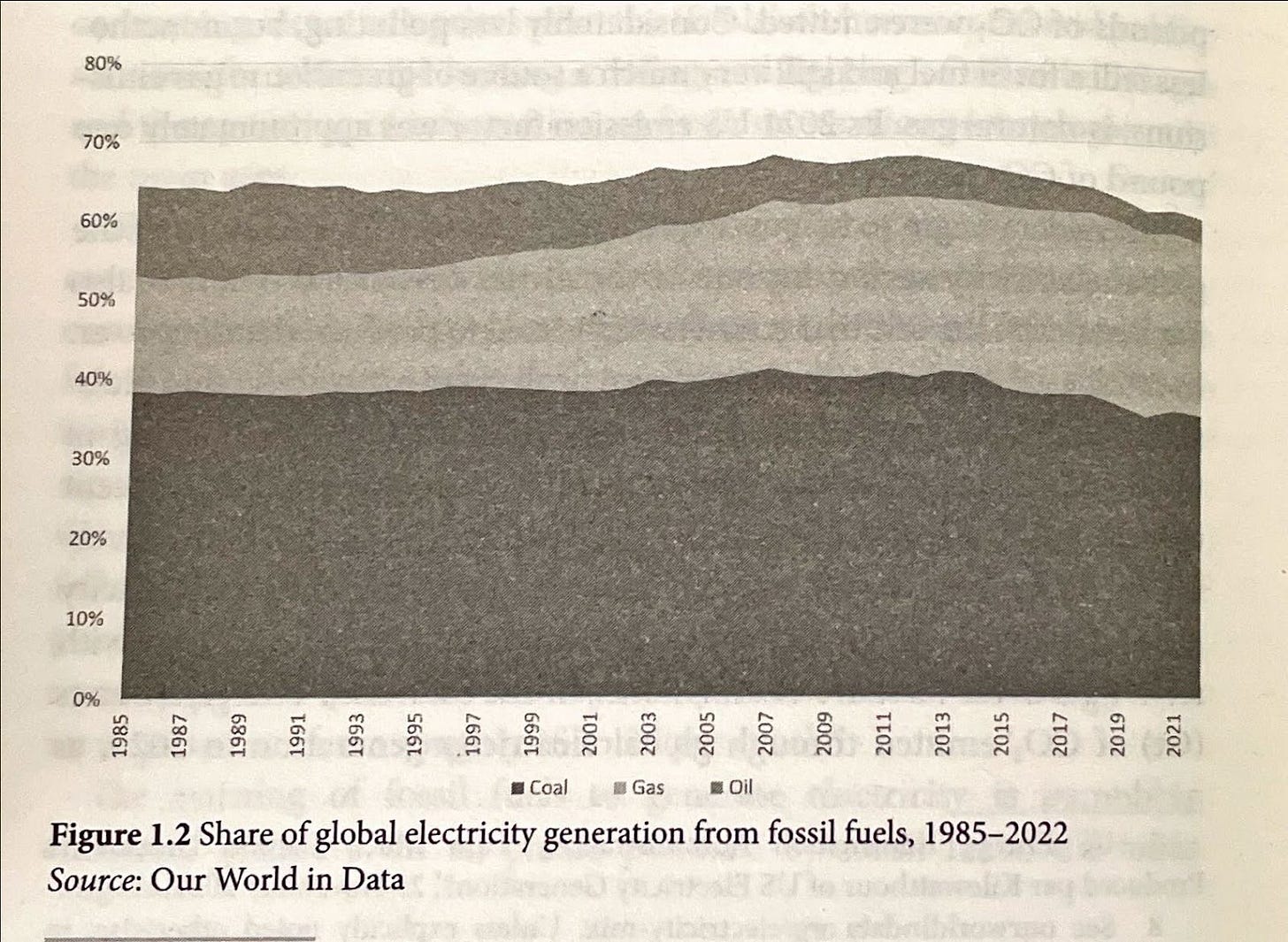

The book’s frame is the failure of the world to move away from fossil fuels in electricity. To substantiate this, here’s the key figure, p. 6, which depicts the share of global electricity generation from fossil fuels from 1985-2022:

The point of this graph is that it isn’t changing. The fossil fuel share of electricity generation has hardly budged over the past 4 decades. In 1985, coal, gas, and oil accounted for 64% of electricity production, and in 2022 they were at 61%. Oil drops and gas rises, but it’s just pretty static.

But this “static” nature is a bit deceptive, though the reality strengthens rather than undercuts the book’s framing. The use of share rather than totals masks the massive increase in total electricity generated (and used!), so there are far more emissions coming from fossil electricity in 2022 than in 1985. At a first order level, this is like so many other things, a China story. Chinese coal generation in 1985 was 260 TWh but had increased 20x by 2022 to 5397 TWh. So, things are bad in electricity emissions. (To be completely clear, more electricity is a good thing. Energy poverty is real and pernicious. While waste should be avoided and emissions must be reduced, abundance must be the goal.)

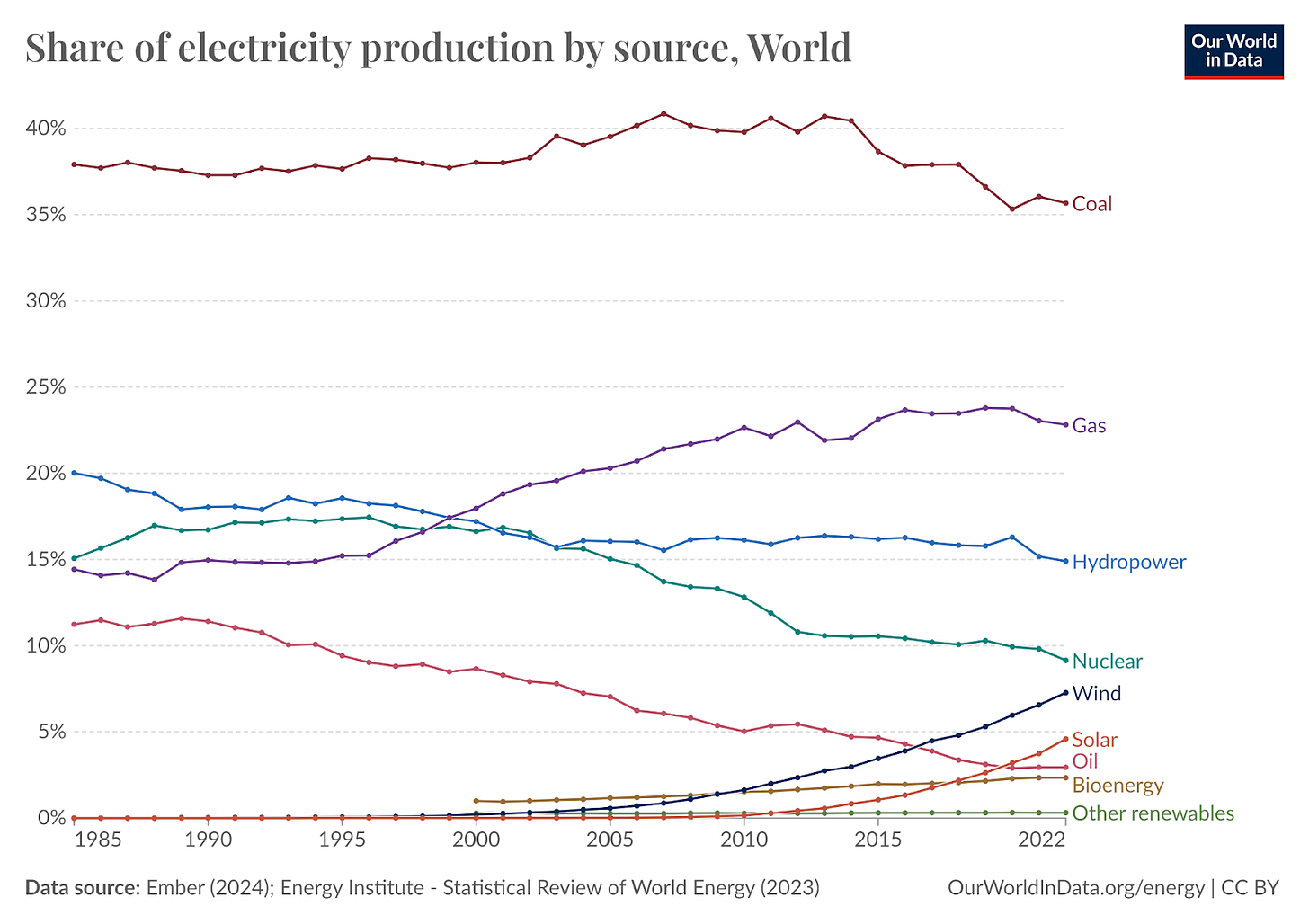

Since he uses the excellent Our World in Data, let’s zoom into a bit more detail here.

Christophers focuses on how the fossil fuel share of electricity remains stubbornly high. And he notes (p. 7) that one reason for this persistence is the drop in nuclear power’s share from 18% to under 10%. That loss alone is more than wind’s share in 2022 (just a little over 7%). Hydropower too drops from 20% to 15%, wiping out solar’s share. Though again remember that the ebbing of nuclear and hydro is mostly because they are not growing as fast as overall demand. A few nuke sites have been shuttered, of course, but mostly these technologies are not keeping up with the sector’s overall growth trend.

But, like it was so often in calculus class, the main point of contention here is the curvature of the wind and solar lines. Are they merely growing linearly from a tiny base, or are they world-changing exponential curves? Will solar and wind continue to chip away 1% of generation a year from fossil fuels or something more? Can you see a hockey stick of hope, as Anthea Roberts, Nicolas Lamp put it in Phenomenal World last year?

Some do. Kingsmill Bond, Sam Butler-Sloss, and Daan Walter at RMI put out a provocative slide deck entitled: The Cleantech Revolution. The following is the image from that deck that most strongly dispels the downbeat framing that suffuses Christophers book.

These technologies are coming online faster than anything we’ve ever seen before and still accelerating (well, at least solar is). Is it fast enough? No, but it’s hard for me to look at this figure and argue that fundamentally bad economics is holding back clean technologies.

One advantage for me is I’m writing this in 2024, a year or so further into the revolution than Christophers was when he turned his book in. The timeline of book publishing precludes Christophers’ analysis from being up-to-date on the latest developments. (ed — Wait, aren’t you writing such a book? Yes, I guess some people just like to live dangerously.)

Following the Russian full-scale invasion of Ukraine, Europe did burn a tiny bit more coal and construct LNG terminals as it broke away from dependence on Russian gas, as Christophers notes. But Europe subsequently saw an impressive renewables buildout that helped cut fossil fuel use and emissions in electricity generation 19% in 2023 from the year before. The US built more solar in the past four years than in the previous twenty. China deployed more solar power in 2023 (217 GW) than the US has in total. China’s 2024 data are running about 30% ahead of last year. India just released statistics showing in the first quarter of 2024 it installed a record amount of solar (10 GW) as well. Some analysts are beginning to think China’s emissions will peak this year, with global emissions perhaps following a year later. This is largely because of the astoundingly fast adoption of solar and wind (and batteries).

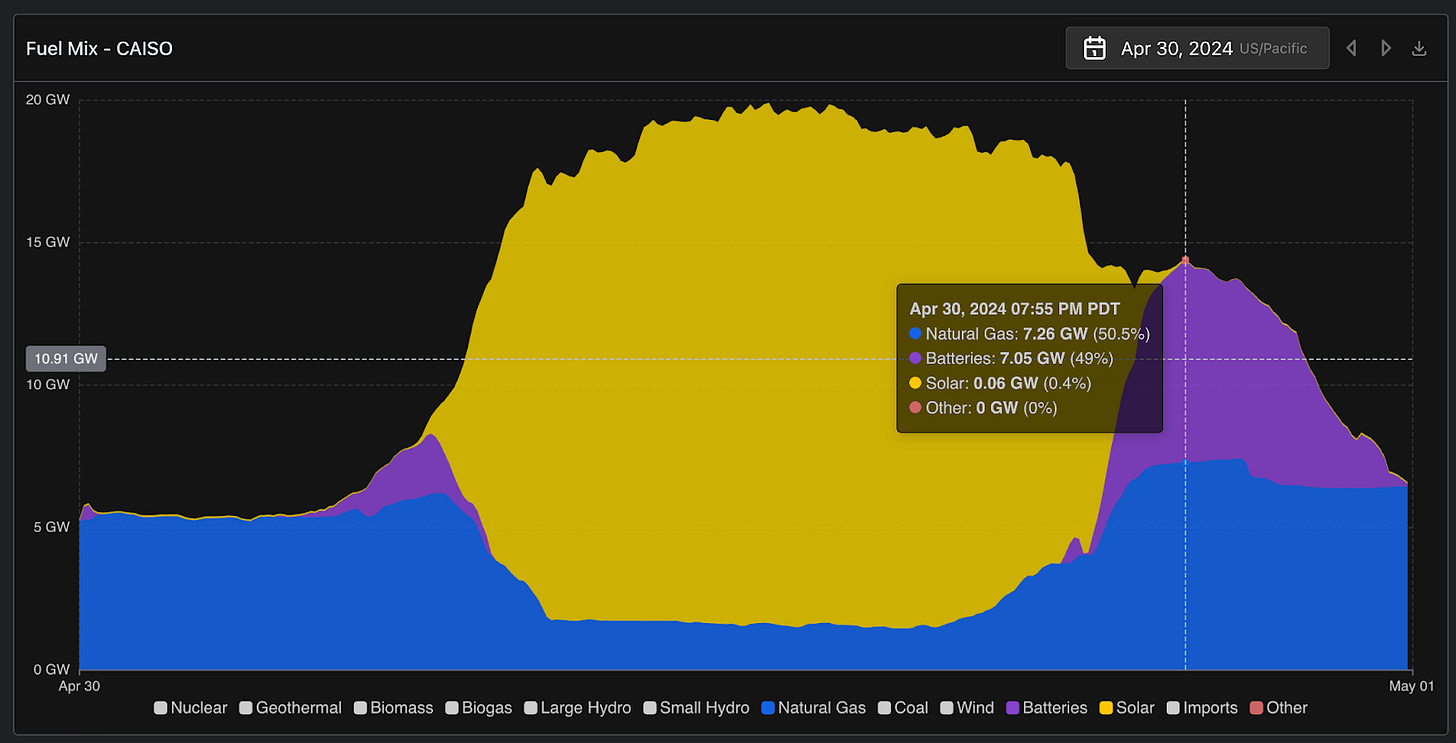

Yes, batteries. Almost completely unacknowledged in the book, cheap batteries solve major problems for variable renewables-led decarbonization. The incredible data resource GridStatus.io put out a post noting how California’s batteries are taking solar power into the evening, deeply cutting into gas generation. To understand what is happening in these graphs, you have to realize that the X-axis is hours of the day. Natural gas dips during the middle of the day as solar displaces it, before rocketing up to an evening peak. This is a variety of the “duck curve,” showing steeper and steeper ramps upward year over year. Until 2024, that is, when gas generation is eviscerated with average peaks over 5 GW rather than the 10 GW of previous years.

What happened? Batteries. Yellow is solar, blue is gas, and purple is batteries.

Rather than a duck curve, I’ve seen this described as a snail curve (a purple snail with a yellow shell on its back). The scale of services batteries are providing here is immense. On April 30, 2024, batteries provided a record 7.05 GW of power to the California grid. The largest nuclear facility in the US is the Vogtle plant in Georgia, which produces 4.5 GW. Now, obviously a nuclear power plant that runs 90+% of the time is very different from a battery that shifts electricity around in time. But on the other hand, the 3rd and 4th reactors at Vogtle were only completed in the past two years despite construction starting in 2009. After seven years of profoundly expensive delays, their total cost clocked in at around $35 billion. So, adding 2.235 GW took 14 years and $35 billion.

Oh, and that record from the end of April -- 7.05 GW -- has already been bested in California. On June 19, batteries provided 7.78 GW to the grid.

Batteries help fight cannibalization of solar energy (wind faces similar issues but not as directly). Think about those leading lads of the most basic econ lessons of all: supply and demand. Prices drop when supply exceeds demand, and vice versa. As Christophers emphasizes, a key feature of the “free gifts of nature” is that they tend to produce at the same time when their neighbors do, often flooding the grid with cheap electrons. This can even get to the point of producing negative prices, as some power plants are costly to turn off (think of a nuclear plant, a heat/electricity facility that can’t stop producing heat and so needs to sell the electricity, or a solar plant that gets paid in subsidies for what it generates). Negative prices and profitability are of course antagonists. But batteries can supplement demand at moments of peak production and shift it to moments when the supply is short--like when the sun goes down. This kind of price arbitrage is already happening, and likely to expand as batteries become cheaper.

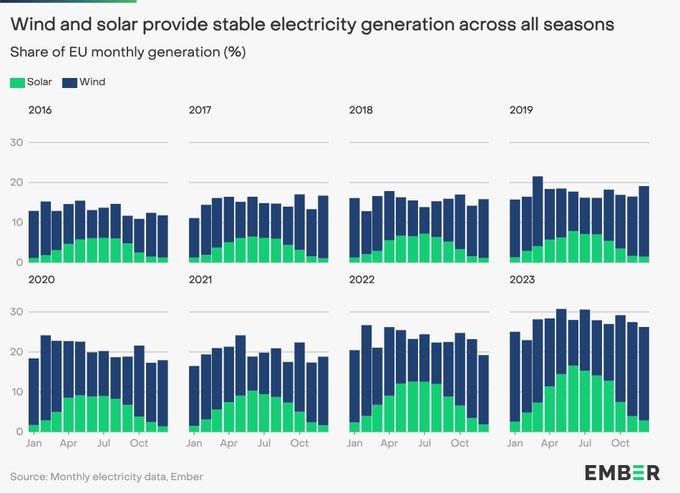

To be sure, batteries aren’t enough to solve all issues with clean electricity production. I’m optimistic that they’ll basically resolve day/night (diurnal) cycles, but we have to accept that the economics just don’t work to have a battery that only sells power back to the grid after two cloudy days in a row, let alone one that backs up and is ready for a particularly bad moment when there’s no wind or sun for a week. There is an amazing German word for this: dunkelflaute “dark doldrums.” But even in the land where this term originated, there is complementarity between solar and wind -- both across a day (windier at night!) and a year (windier in the winter).2

The level of complementarity of solar and wind varies by geography, but it’s not all bad news. Here’s a link to a scholarly article simulating potential complementarity between solar, wind, and hydro in Chinese provinces. That being said, wind is incredibly variable day by day and week to week.

I’ve been using batteries as short-hand for the standard lithium ion batteries that are ubiquitous, but other kinds of batteries might help resolve some of these issues of supply/demand mismatch through energy storage.

Sodium-ion batteries. If you’re worried about lithium extraction for either economic or environmental reasons (and you probably should be!), sodium can replace lithium without radical performance losses. Lithium is the best metal for EV batteries, for instance because it holds a lot of charge and is light. The lightness doesn’t matter for a stationary grid battery, so sodium may help expand the range of battery uses for the grid.

Iron-air batteries or other kinds of long-duration energy storage. The US Department of Energy laid out a “liftoff report” on long-duration energy storage that is as full of technical detail and acronyms as you might hope.

Heat batteries. A huge amount of emissions, especially in industrial processes, come from burning fossil fuels to produce heat. If there’s too much electricity available at a given moment, a heat battery can use that electricity to generate heat and then store the heat, almost indefinitely without substantial losses. Rondo Energy makes a “box of rocks” style heat battery just inked a deal with a plastics recycler: Groundbreaking clean energy with molecular recycling | Eastman

Hydrogen, pumped hydro, compressed air, all manner of wacky tech here.

This is already getting too long, but with more time, I’d probably riff on how batteries challenge one of the more theoretical ideas in the book. Christophers claims that electricity is a fictitious commodity a la Polanyi alongside land, labor, and money. Storage turns electricity from this instantaneously produced and consumed phenomenon that simultaneously hardly exists as a commodity and underlies modernity into something that much more easily fits into commodity markets. Some diversified portfolio of clean generation dominated by solar and wind and supplemented by storage, hydro, nuclear, geothermal, hydrogen, seems quite likely to get the world to 90+% fossil-free electricity in the next two decades.

I’ll end with what is an unfair criticism. It is precisely because the book abjures political factors that are slowing down the energy transition that it is able to get into the depth of the economic analysis that it provides. Yet while the book is obviously correct that subsidies remain an important piece of the economics of renewables despite cost declines, the idea that these technologies can’t quickly form the basis of a new decarbonized electricity system because of their economics feels questionable. The rich discussion of current market structures that shape the way electricity is made, funded, subsidized, stabilized, insured, and ultimately bought and sold is told in a negative mode: about what is wrong with solar and wind and electricity markets economically.

The book is convincing about the need for those structures to change, including perhaps even radical changes. However, would-be reformers need to know that the real barriers to these technologies expanding even more rapidly are political not economic. And there are no real quick fixes here. The Build Public Renewables Act which passed last year in New York and has been heralded as a critical turn in the energy transition is, at least at this point some 14 months in, a nothingburger. Here’s the New York Power Authority:

Q: What types of projects will NYPA develop? Where will they be located?

A: NYPA has not yet made any decisions on specific projects it will advance. Proposed projects will be identified in NYPA’s strategic plans and annual updates. NYPA will solicit stakeholder input as part of the development of the strategic plans and annual updates and through an annual conferral process.

So far, there’s a list of 79 “partners” that looks basically just like the various renewable developers that are already active in the state and a promise that it will release a strategic plan in January 2025.3 This is not my idea of a cleantech revolution pursued with urgency to meet the moment. And we really shouldn’t expect it to be, because the real bottleneck with renewable deployments isn’t profits but politics. Politics in remote areas, neighborhoods, towns, and cities, in the United States, China, and Europe, but also in Nigeria, Mexico, Brazil, and South Africa. It’s politics (and political economy) all the way down.

It’s the boring issues of siting, permitting, interconnecting, and paying for grid expansion that is holding back further deployment of these technologies. It’s figuring out how great of losses are coal plants in China going to be forced to eat as they become stranded assets when renewables plus storage overwhelm their economics. It’s figuring out how Indian politicians can win elections while pushing policies that both lay off millions of coal miners and extend the lives of the country’s 1.4 billion people. It’s the politics of changing public opinion in a pro-nuclear direction, or that fracking isn’t inherently bad if it is being used for enhanced geothermal technologies. It’s the politics of getting people and businesses to insulate their homes, to let construction happen in their backyards, and to invest in public transportation. It’s the politics of rate design and rightsizing subsidies for distributed energy resources. It’s the politics of standardizing grid connections and hardening distribution and expanding transmission. It’s the politics of extracting public utilities commissions in the US from their incestuous relationships with fossil-fueled utilities. It’s the politics of regulating out of existence wasteful energy uses like crypto rather than subsidizing them. It’s the politics of making renewables good jobs and transitioning fossil fuel communities to cleaner labor. It’s figuring out market design and business models for virtual power plants that don’t infuriate customers by leaving them to bake during a heatwave or failing to charge an EV before a family road trip. It’s the politics of implementing congestion pricing in New York City rather than cowering away from it at two minutes to midnight because of a fear of car culture backlash. It’s the politics of imagining energy abundance and realizing that it is coming. And it’s the geopolitics of a new energy world, where China thoroughly dominates the supply chain in a way that would make OPEC+ blush.

And if that feels daunting, well, it should, but it should be exciting as well. Millions die every year from inhaling smoke from burning fossil fuels. We are so close to a better world, and we’re getting there today, one solar farm and wind installation at a time.

Christophers may be right that the price is wrong, but the vibes are right.

The book elides a bit here as while the minute to minute variability of electricity prices can be immense, over time this variance should settle down thanks to the law of large numbers. That is, while a project might not know how sunny or windy it will be on a given day, they have quite reasonable estimates of both the annual generation and the pricing. That being said, extremes can break the finances of any project as the Texas/Oklahoma winter storm case shows.

Many references to not having enough critical materials to transition away from fossil fuels often track back to analyses that suggest we need something like four weeks of battery storage, which is just not the way that this will work.

Maybe it will astound everyone with it’s ambition, but given Hochul’s epic own goal on congestion pricing, I’m dubious. I hope it does!

![The Price is Wrong: Why Capitalism Won't Save the Planet [Book] The Price is Wrong: Why Capitalism Won't Save the Planet [Book]](https://substackcdn.com/image/fetch/$s_!0vIN!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc938a34f-74de-4970-b84a-d0d9282dee7c_423x650.jpeg)